stock option sale tax calculator

Poor Mans Covered Call calculator addedPMCC Calculator. Stock Option Tax Calculator.

How Are Options Taxed Charles Schwab

Ad Find A One-Stop Option That Fits Your Investment Strategy.

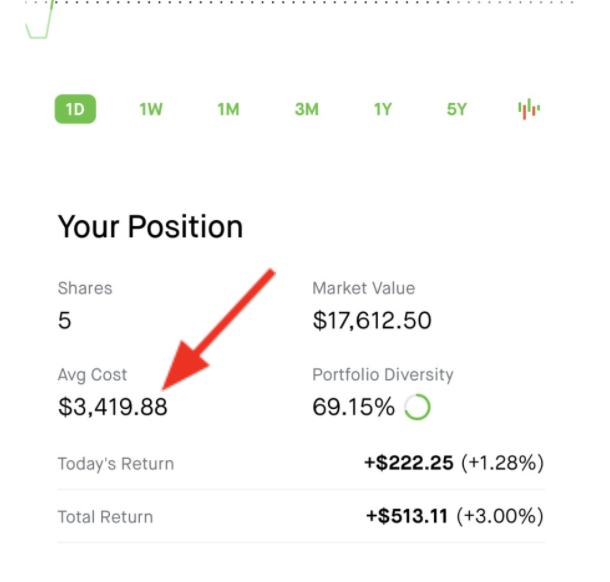

. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share of company stock. How much are your stock options worth. Enter the number of shares purchased.

Ad Trade with the Options Platform Awarded for 7 Consecutive Years. So timing your stock. Get Started In Your Future.

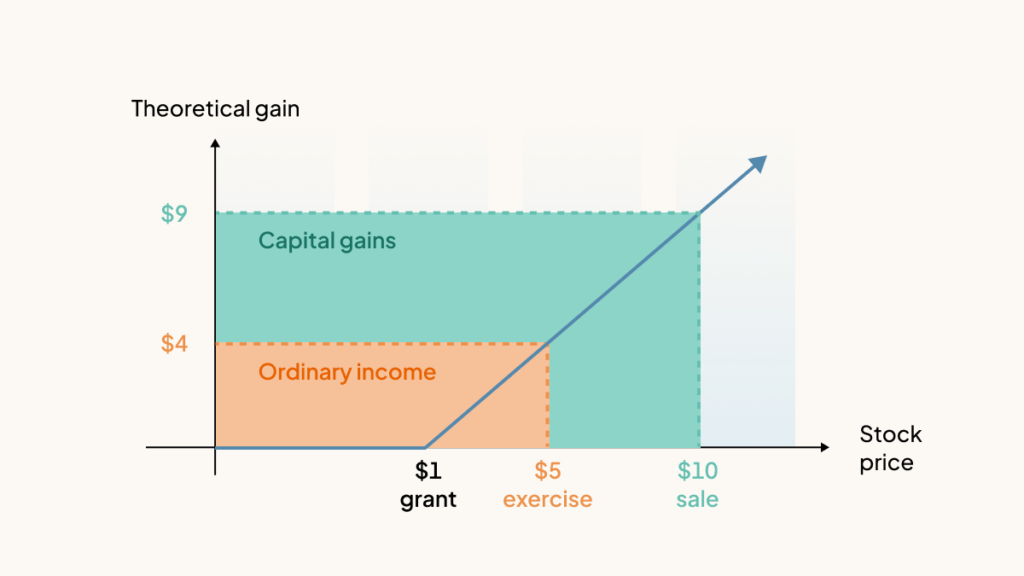

In our continuing example your theoretical gain is zero when the stock price is 1 or lowerbecause your strike price is 1 you would pay 1 to get 1. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Use the employee stock option calculator to estimate the after-tax value of non-qualified stock options before cashing them in.

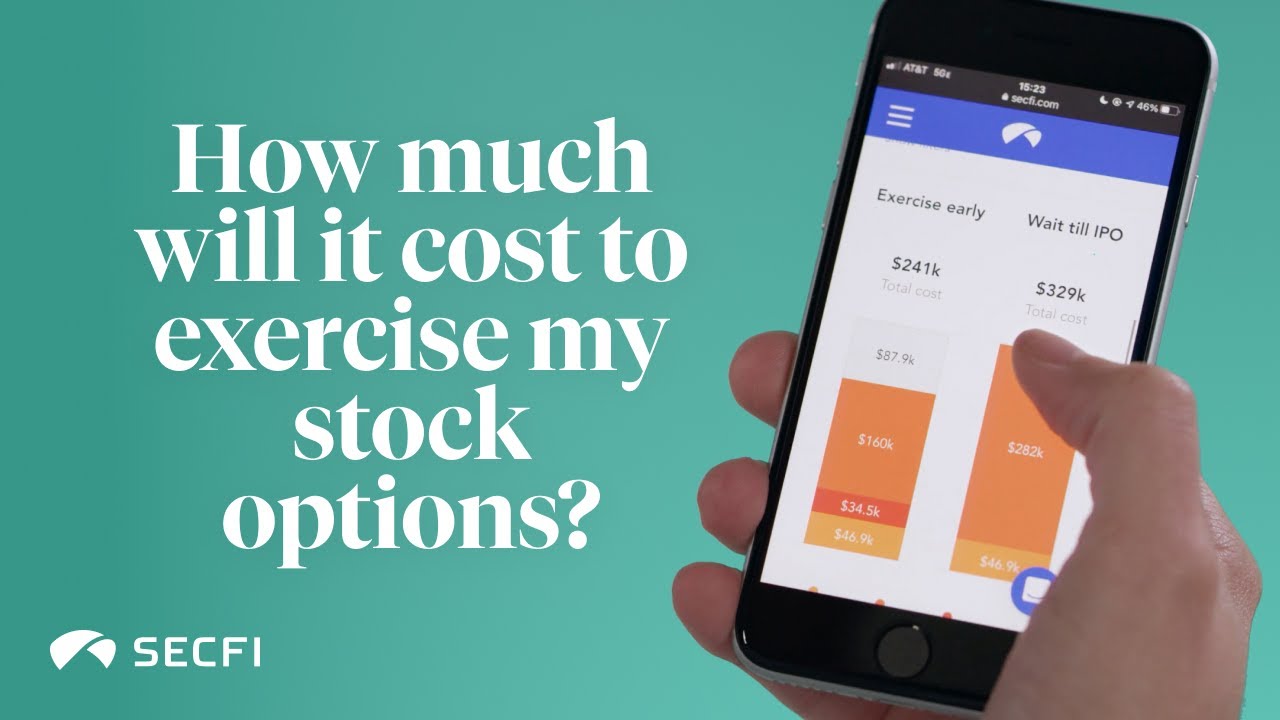

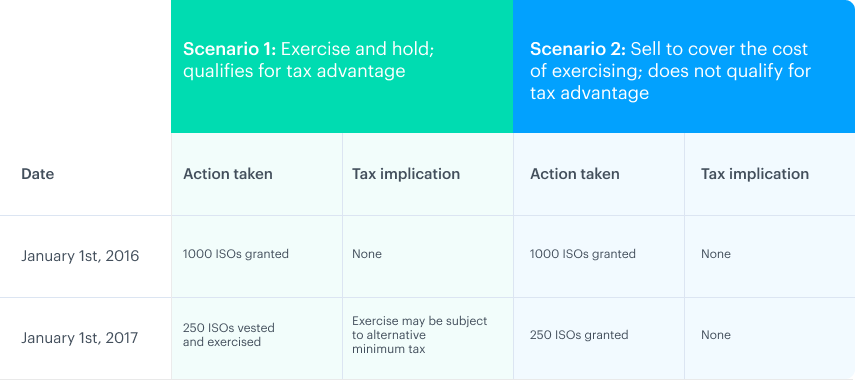

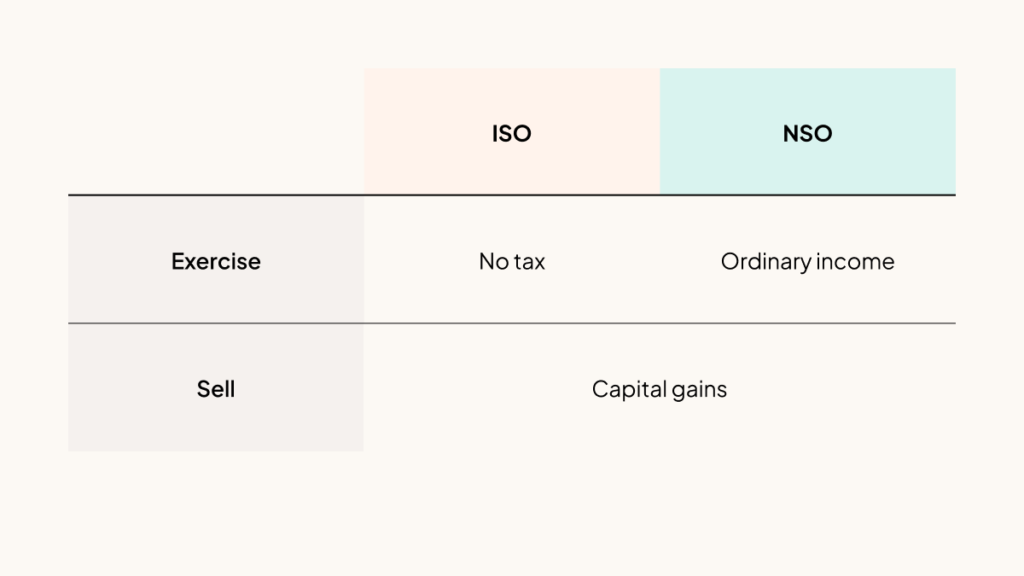

This calculator illustrates the tax benefits of exercising your stock options before IPO. The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term capital gains compared with a maximum rate of 37 on ordinary income not including the 38 for the net investment income. If the exercise price is 10 and you have 100 NSOs you would pay the.

Just 1option to open 0 to close. And a commission cap at 10leg. Please enter your option information below to see your potential savings.

Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the. It can also show your worst-case AMT owed upfront total tax and its breakdown. On this page is a non-qualified stock option or NSO calculator.

Open an Account Now. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. 60 of the gain or loss is taxed at the long-term capital tax rates.

Abbreviated Model_Option Exercise_v1 - Pagos. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net proceeds. Ad See the options trade you can make today with just 270.

Ordinary income tax and capital gains tax. The Stock Option Plan specifies the total number of shares in the option pool. This permalink creates a unique url for this online calculator with your saved information.

Exercise incentive stock options without paying the alternative minimum tax. Enter the commission fees for buying and selling stocks. Enter the purchase price per share the selling price per share.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. The Stock Option Plan was approved by the stockholders of the grantor within 12 months before or after the date. Lets get started today.

NSO Tax Occasion 1 - At Exercise. Enter the number of shares purchased. If you receive an option to buy stock as payment for your services you may have income when you receive the option when you exercise the option or when you dispose of the option or stock received when you exercise the option.

Youre basing your investing strategy not on long-term considerations and diversification but on a short-term tax cut. This calculator lets you estimate how much it will cost you to exercise your options or will help you compute the gain in a given exercise and sale scenario. You make a 147 pre-tax gain on each ISO you sell 150 3 strike price For each sold ISO you owe 6615 in ordinary taxes 147 45 Your net gain is 8085 per ISO.

Non-qualified Stock Option Inputs. The How to guide on trading options and the 5 laws of options you must obey. New Tax Laws Recently there has been a rise in tax proposed on long-term capital gains from 20 percent to 396 percent by President.

40 of the gain or loss is taxed at the short-term capital tax rates. Back to Calculators Talk to sales 800-225. And if you re-purchase the stock youre essentially deferring your capital gains taxation to a later year.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. Ad Manage volatility w a tool that directly tracks the vol market. Calculate the costs to exercise your stock options - including taxes.

The Stock Calculator is very simple to use. You exercise your options and hold at least one. Ad Financial Security is Attainable.

But when you exercised your ISOs earlier you already paid 45000 for the strike price and. Discover Which Investments Align with Your Financial Goals. Ad Trade with the Options Platform Awarded for 7 Consecutive Years.

Capital Gains Tax Calculator. The taxation of options contracts on exchange traded funds ETF that hold. Find a Dedicated Financial Advisor Now.

VIX options and futures. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. Open an Account Now.

Ad tastyworks is built for speed with features for the active trader. Ad This free guide contains an easy 3 step process to trade options in todays market. A long-term capital gains tax calculator calculates the tax on the profit from the sale of an asset according to your taxable income and your marital status.

The following table shows an example of how much stock option values would be at various growth levels for an employee who annually obtained 1000 stock option grants at a strike price matching the current company share price of 100 per share over the course of 15 years. Just follow the 5 easy steps below. There are two types of taxes you need to keep in mind when exercising options.

Build Your Future With a Firm that has 85 Years of Investment Experience. Before you can use the tool to its full potential youll have to gather some data and make. Decide whether to exercise your stock options now or later.

Ad Were all about helping you get more from your money. Section 1256 options are always taxed as follows. You can also add sales.

Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again. On this page is an Incentive Stock Options or ISO calculator. Free strategy guide reveals how to start trading options on a shoestring budget.

Specify the Capital Gain Tax rate if applicable.

How To Deduct Stock Losses From Your Taxes Bankrate

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

What Are Incentive Stock Options Isos Carta

Secfi Stock Option Tax Calculator

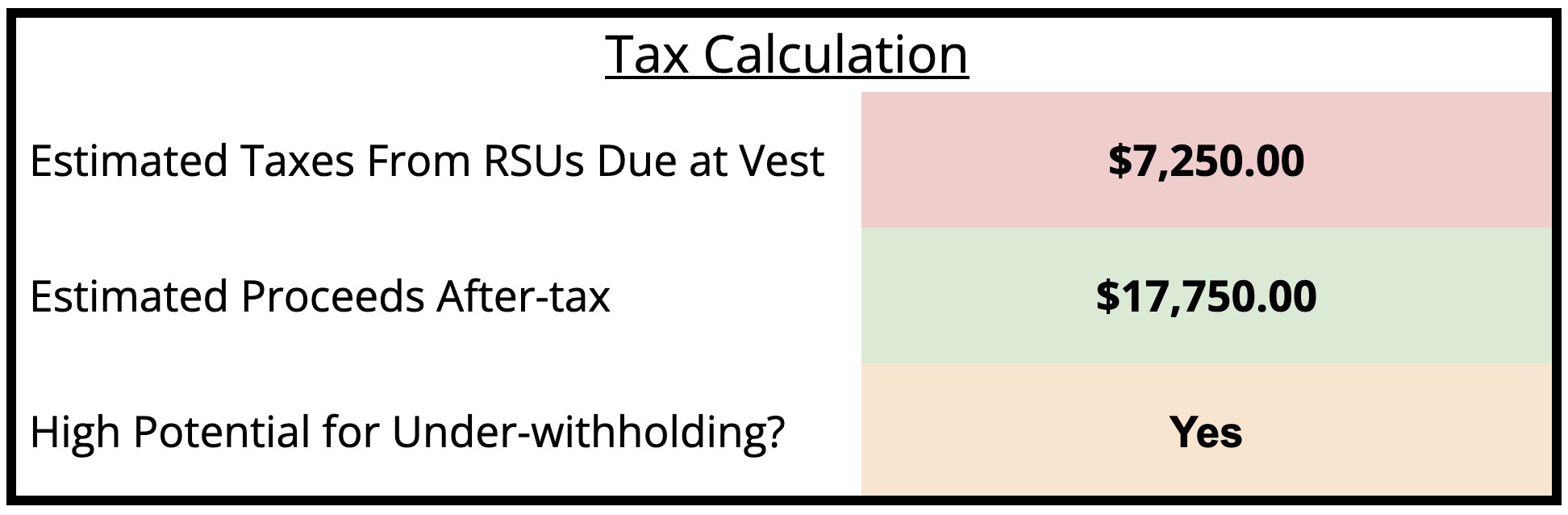

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

What Is A Disqualifying Disposition With Incentive Stock Options What Can Cause It And Why Does My Company Care Mystockoptions Com

Short Term Capital Gains Tax Rates For 2022 Smartasset

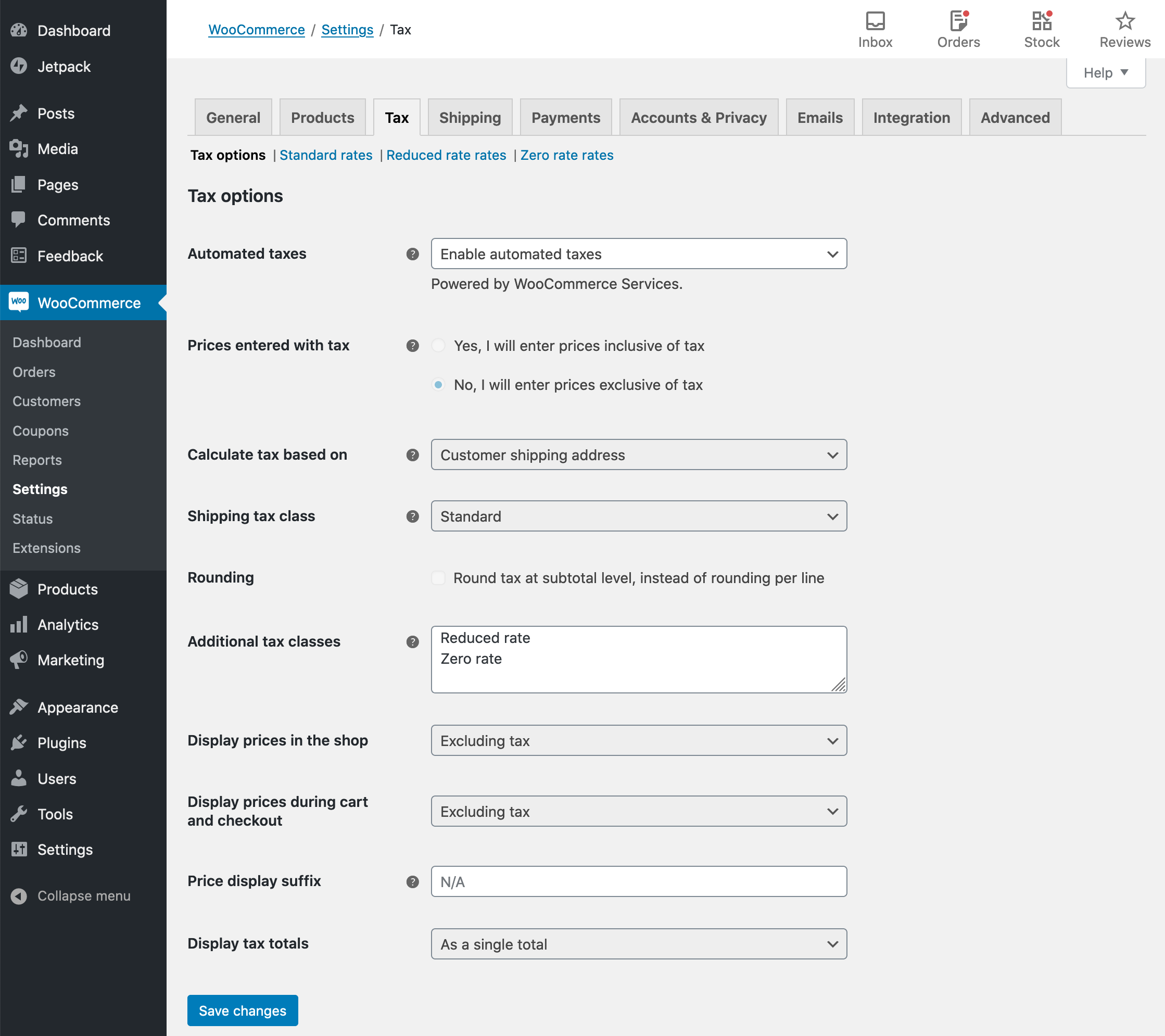

Woocommerce Tax Guide Woocommerce

How To Calculate Iso Alternative Minimum Tax Amt 2021

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

8 Tips If You Re Being Compensated With Incentive Stock Options Isos

Sales Tax Calculator Double Entry Bookkeeping

How Are Stock Options Taxed Carta

How Are Stock Options Taxed Carta

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

How To Selling Stock Options When You Re In The Highest Tax Bracket